Share this article:

Why Isn’t Your Forex Brokerage Profitable?

Key Takeaways:

-

Many forex brokerages struggle with profitability due to poor liquidity management, high trading costs, and inefficient order execution.

-

Understanding A-book vs. B-book models, market-making strategies, and effective risk management can help boost profitability.

-

The right technology, liquidity solutions, and operational strategies can significantly enhance the financial health of a forex brokerage.

The forex market sees over $7.5 trillion in daily trading volume, yet many brokers find themselves struggling to maintain profitability. A successful brokerage must balance liquidity, risk management, and operational efficiency. Without the right approach, even a well-funded operation can suffer from high churn rates, poor execution, and revenue shortfalls.

Understanding the key challenges and optimizing critical business functions can mean the difference between growth and stagnation. In this article, Shift Markets breaks down the common reasons forex brokerages fail to turn a profit and explores strategies to create a sustainable and scalable business.

The Common Profitability Challenges Forex Brokers Face

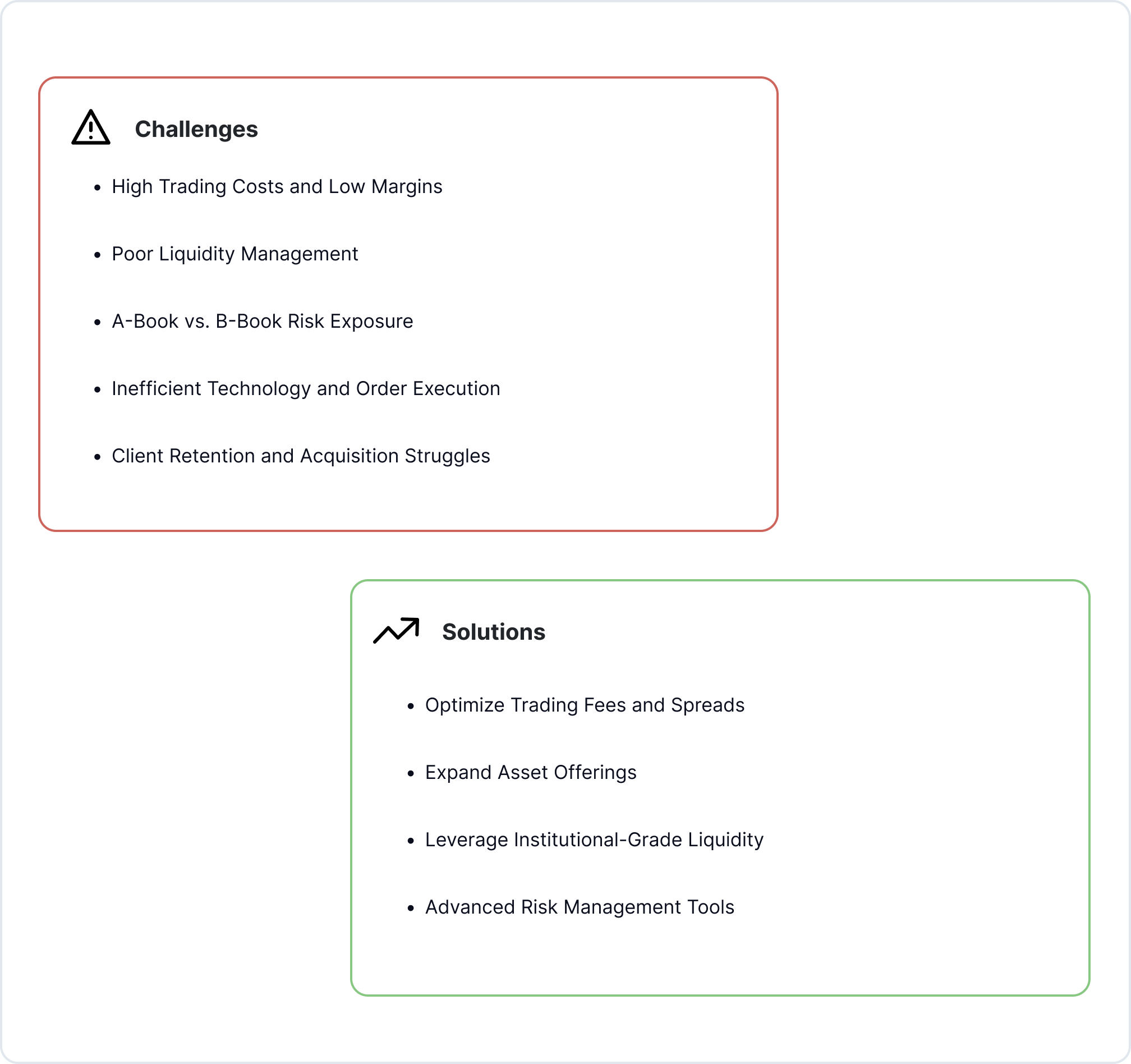

Scaling a forex brokerage comes with significant profitability challenges. From high trading costs and liquidity issues to technology limitations and client retention struggles, addressing these challenges is essential for success. Below are some of the most common obstacles brokers face and strategies to overcome them.

High Trading Costs and Low Margins

Forex brokers rely on high trading volumes to offset razor-thin spreads, but uncompetitive pricing and high transaction costs drive traders away. Optimizing order execution and reducing costs through liquidity aggregation can enhance margins while maintaining competitive spreads.

Poor Liquidity Management

Liquidity affects execution speed, spreads, and trader satisfaction, with poor liquidity leading to slippage, market risk, and failed orders. Utilizing multiple liquidity providers and smart order routing helps minimize slippage and enhance trading conditions.

A-Book vs. B-Book Risk Exposure

Brokers use different models to manage profitability: the A-Book model relies on commissions with lower margins, while the B-Book model profits from client losses but carries higher risk. A balanced approach between both can stabilize earnings and mitigate risk.

Revenue Strategies to Improve Profitability

Maximizing profitability requires a strategic approach that optimizes pricing, asset diversity, liquidity access, and risk management. By implementing these key strategies, brokers can increase revenue, enhance trading conditions, and drive long-term growth. A well-balanced mix of competitive pricing, deep liquidity, and diversified market offerings attracts traders while maintaining strong operational efficiency.

Optimize Trading Fees and Spreads

Offering competitive yet sustainable spreads attracts more traders while preserving margins. By implementing dynamic pricing models, brokers can adjust spreads in real-time based on market conditions, ensuring both profitability and competitiveness.

Expand Asset Offerings

Multi-asset trading, including crypto, commodities, and indices, diversifies revenue streams while offering traders more opportunities. Expanding trading pairs enhances engagement and boosts trading activity.

Leverage Institutional-Grade Liquidity

Deep liquidity pools enhance execution speed and minimize slippage, while advanced liquidity aggregation tools provide better pricing and tighter spreads, improving overall trading conditions.

How to Scale Your Forex Brokerage Efficiently

To scale your forex brokerage efficiently, a high-performance trading infrastructure is crucial. Fast execution speeds and robust platform reliability not only enhance market efficiency but also improve user experience, attracting serious traders. API integrations further support scalability by enabling automated trading solutions and customizable tools, allowing brokers to adapt to evolving market demands.

For brokers aiming to expand quickly, white-label brokerage solutions provide pre-built, scalable platforms that significantly reduce time-to-market. These solutions support both startups and established firms, offering a streamlined way to scale operations without the complexities of building a trading platform from scratch.

Equally important is compliance and regulatory readiness, as maintaining regulatory standards ensures long-term stability. Navigating global regulations safeguards business continuity, while automated compliance tools simplify KYC/KYT processes, reducing operational burdens and enabling seamless expansion into new markets.

Conclusion

Profitability in forex brokerage is a delicate balance of liquidity management, risk strategies, and operational efficiency. Many brokers struggle due to high costs, poor execution, and inadequate infrastructure. However, by implementing optimized trading conditions, leveraging liquidity providers, and using cutting-edge technology, a brokerage can significantly improve its financial outlook.

At Shift Markets, we provide comprehensive solutions that empower forex brokers to enhance profitability. Our technology-driven trading infrastructure, deep liquidity access, and tailored risk management tools enable brokers to scale successfully in today’s competitive forex landscape.

Ready to optimize your brokerage for long-term success? Contact Shift Markets to explore the best solutions for your business.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!