Share this article:

Key Takeaways:

-

Smart order routing ensures best execution by automating order flows, analyzing critical factors, and optimizing trade outcomes across multiple venues.

-

By reducing transaction costs, accessing deeper liquidity, and enabling fast trades, smart order routing benefits both institutional and retail platforms.

-

Technologies like AI, machine learning, and blockchain integration are shaping the next generation of trading platforms, making smart order routing indispensable.

What is Smart Order Routing

In the dynamic trading landscape of 2025, smart order routing (SOR) is a crucial tool for modern financial markets. By leveraging SOR, exchanges and brokers achieve best execution, enhance trading efficiency, and unlock access to deeper liquidity. This positions them as leaders in today’s highly competitive environment.

Integrating smart order routing improves operational efficiency, reduces transaction costs, and provides seamless trading experiences for institutional and retail traders. Whether in traditional financial markets or emerging crypto ecosystems, SOR optimizes trade flows and manages liquidity effectively. This makes it an indispensable tool for trading platforms.

In this article by Shift Markets, we dive into the versatility of smart order routing. We explore how it ensures optimal trade execution, improves efficiency across markets, and plays a growing role in diverse trading environments, including institutional platforms and decentralized exchanges.

How Smart Order Routing Works

Smart order routing automates the process of directing trades to the most optimal venues, ensuring seamless execution while reducing delays and errors. The system evaluates key factors like price, speed, and liquidity to achieve the best possible trade outcomes. By prioritizing favorable pricing and minimizing slippage, it enhances efficiency in volatile markets. Advanced algorithms drive SOR, analyzing market conditions and venue performance in real-time. This ensures orders are executed with precision, delivering consistent, high-quality results across competitive trading environments.

Benefits of Smart Order Routing

Smart order routing transforms trading by optimizing execution, improving liquidity access, reducing costs, and scaling to meet the diverse needs of modern markets:

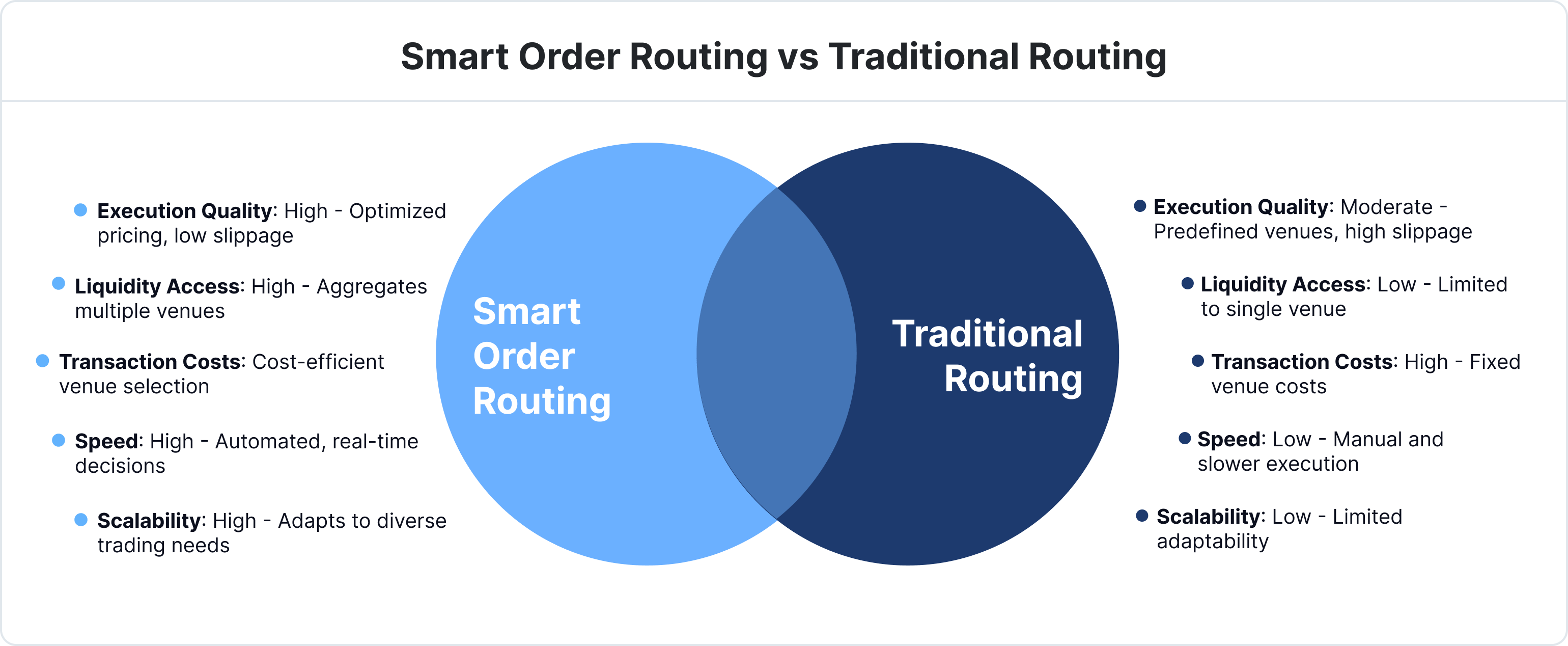

Smart order routing outperforms traditional routing by optimizing execution, enhancing liquidity access, reducing costs, improving speed, and offering greater scalability.

Optimal Trade Execution

SOR routing ensures trades are directed to venues with the most favorable prices, optimizing execution quality. This reduces slippage and enhances trader confidence. By analyzing factors like bid-ask spreads and order depth, SOR guarantees traders achieve the best possible outcomes.

Enhanced Liquidity Access

SOR routing connects to multiple trading venues, aggregating liquidity and reducing spreads. This access supports larger trades without impacting prices, benefiting both retail and institutional traders. With improved liquidity, exchanges can attract high-caliber traders and sustain competitive trading environments.

Cost-Effective Trading

SOR routing reduces transaction costs by prioritizing venues with lower fees and favorable conditions. Automation also minimizes manual errors, saving time and resources. These efficiencies help exchanges and traders optimize profitability while maintaining reliable performance.

Fast Trading Speeds

Automated routing ensures trades are executed quickly, critical for markets where prices change rapidly. SOR enhances response times, giving traders a competitive advantage. In high-volatility environments, speed is essential to capitalize on opportunities and mitigate risks.

Scalable Trading Solutions

SOR routing accommodates diverse trading needs, from simple retail orders to complex institutional strategies. Its adaptability ensures efficient operations across multiple asset classes and market types. This scalability makes SOR a vital tool for exchanges seeking growth.

Challenges and Considerations of Smart Order Routing

While smart order routing offers significant advantages, it also presents challenges that must be addressed to ensure seamless and effective implementation:

Latency-Related Risks

Delays in routing can lead to missed opportunities, particularly in fast-moving markets. Addressing latency requires advanced infrastructure and low-latency solutions to maintain competitiveness. Exchanges must prioritize speed to meet traders’ demands for real-time execution.

Technological Complexity

The algorithms driving SOR require constant evaluation of price, liquidity, and venue performance. This complexity can pose challenges for smaller platforms. Regular updates and sophisticated technology are necessary to ensure seamless and effective routing operations.

Limited Transparency

Complex routing decisions can be difficult to explain, causing trust issues among traders. Providing clear reporting on routing processes can enhance transparency and user trust. Educating users about SOR’s benefits and functionality is key to overcoming this challenge.

Regulatory Compliance Challenges

SOR must align with global financial regulations, including best execution policies and reporting standards. Non-compliance can result in legal issues and reputational risks. Adapting systems to meet regional regulations is crucial for long-term operational success.

Infrastructure Reliability Issues

Reliable infrastructure is essential to handle the data-intensive processes required by SOR Downtime or failures can disrupt trading and damage credibility. Regular maintenance and robust systems ensure consistent performance and protect against failures.

Profitable Use Cases of Smart Order Routing

Smart order routing creates value across institutional platforms, retail brokerages, and crypto exchanges by optimizing trade execution, liquidity access, and cost efficiency. Its ability to navigate diverse trading environments makes it essential for platforms seeking profitability and competitive advantage.

Institutional platforms benefit from SOR routing’s advanced algorithms, which execute large-scale trades efficiently while maintaining market stability. Retail brokerages leverage SOR to provide everyday traders with access to competitive pricing and best execution. This improves user trust and drives trading activity, boosting platform growth.

In the crypto space, SOR routing bridges fragmented markets by connecting centralized and decentralized exchanges. It minimizes price disparities, improves efficiency, and enhances transparency, especially for volatile digital assets. Across all use cases, SOR ensures better execution while positioning platforms for sustained profitability.

Future of Smart Order Routing

The future of smart order routing lies in its continuous technological evolution, driven by advancements in AI, machine learning, and blockchain integration. These innovations are redefining trade execution and market efficiency, making platforms more competitive and adaptive.

AI and machine learning are enhancing routing algorithms, enabling them to process and analyze vast datasets in real-time. Research from Deloitte highlights that AI-driven order routing can reduce transaction costs by up to 30% in equity markets. This technology improves decision-making during volatile market conditions, ensuring optimal execution even as markets grow more complex.

Blockchain-based platforms are further revolutionizing SOR by enhancing transparency and efficiency. A notable example is the decentralized exchange Uniswap, which processed over $1.5 billion in daily trading volume in 2024, utilizing automated routing protocols to manage fragmented liquidity pools.

With global cryptocurrency trading volumes surpassing $3.5 trillion in July 2024, the demand for scalable and efficient routing technologies will only increase. SOR’s ability to integrate advanced technologies ensures it remains essential for future trading platforms, driving innovation and improving market performance.

Conclusion

Smart order routing is a gateway to efficient and innovative trading, blending cost optimization with enhanced market connectivity. Its ability to improve execution quality and reduce transaction costs positions it as a defining feature of modern trading platforms. As markets become more complex and fragmented, the role of SOR grows increasingly crucial, ensuring platforms remain competitive and profitable.

The adoption of SOR is not just a technical enhancement; it is a strategic imperative for exchanges looking to meet evolving trader demands. By offering seamless access to liquidity and supporting diverse trading strategies, SOR is shaping the future of financial and cryptocurrency markets.

For exchanges seeking to implement advanced SOR solutions, Shift Markets provides cutting-edge technology designed for scalability and efficiency. With expertise in building innovative trading platforms, Shift provides state-of-the-art enterprise exchange software, ensuring an easy and successful transition into the world of derivatives trading. Take the next step with Shift Markets and revolutionize your exchange offering today.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!