Share this article:

What is MiCA Regulation? A Quick Overview

The Markets in Crypto-Assets (MiCA) Regulation establishes cohesive rules across the European Union for the crypto-asset market. This regulation addresses crypto-assets that fall outside the scope of current financial services laws. It sets out essential requirements for the issuance and trading of crypto-assets, including asset-referenced tokens and e-money tokens, emphasizing transparency, disclosure, authorization, and oversight of transactions.

By introducing this legal structure, MiCA aims to enhance market integrity and financial stability, regulate the public offering of crypto-assets, and improve consumer protection by providing clearer information on the risks involved.

Key Takeaways:

-

The Markets in Crypto-Assets (MiCA) Regulation standardizes crypto-asset rules across the EU, bolstering market integrity and consumer protection.

-

MiCA categorizes crypto-assets into three types—asset-referenced tokens, e-money tokens, and other crypto-assets—with specific regulations for each.

-

All entities operating within the crypto space in the EU, including issuers, trading platforms, custodians, and financial institutions, must prepare for MiCA compliance.

-

Early preparation and engagement with MiCA’s licensing and regulatory processes will be key to traversing the new regulatory landscape successfully.

A Brief History of MiCA

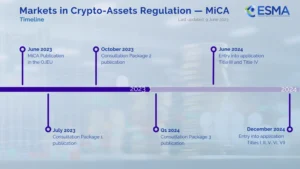

Officially entering into force in June 2023, MiCA is set to be fully applied by December 2024, after a series of public consultations and the release of consultation packages. Designed to enhance financial stability, protect investors, and facilitate innovation within the EU, MiCA stands as a comprehensive framework for crypto-assets, asset-referenced tokens, and e-money tokens. As we approach its full application, businesses and investors must adapt to a unified regulatory landscape that ensures enhanced market integrity and consumer protection.

MiCA’s Expected 2024 Timeline

Source: ESMA

At its most basic level, MiCA regulation introduces a comprehensive set of rules that crypto businesses operating within the European Union will need to comply with. It focuses on enhancing transparency, ensuring fair trading practices, and protecting investors within the crypto market. For crypto businesses, this means adhering to strict operational standards, including obtaining necessary authorizations, maintaining operational resilience, and providing clear information to consumers regarding the risks associated with crypto-assets.

MiCA’s Categorization of Crypto Assets

For crypto businesses, adhering to MiCA entails a deep dive into these classifications to determine which regulations apply to their operations. It’s essential for all types of firms dealing with crypto to understand the authorization process, operational requirements, and consumer protection measures mandated by MiCA.

MiCA categorizes crypto-assets into three main types, each subject to different regulatory standards:

Asset-Referenced Tokens (ARTs)

These crypto-assets aim to maintain a stable value by referencing one or more currencies, commodities, or other assets. Often likened to stablecoins, ARTs require issuers to hold suitable reserves and adhere to governance standards, especially for tokens with widespread use cases.

E-Money Tokens (EMTs)

Representing electronic money, EMTs are crypto-assets that aim to emulate the value of a fiat currency. Issuers of EMTs need authorization from credit or electronic money institutions to ensure EMTs consistently offer a stable and reliable digital representation of fiat currencies.

Other Crypto-Assets

This category encompasses all other types of crypto-assets not classified as ARTs or EMTs, including utility tokens and major cryptocurrencies like Bitcoin and Ethereum. Issuers of these assets must meet specific criteria, including the publication of a whitepaper and adherence to marketing communication standards.

Who Should Get Ready for MiCA?

Additionally, custodians of crypto-assets will need to meet enhanced capital and risk management criteria. The regulation also extends to firms offering portfolio management, investment advice, and payment services using crypto-assets.

Even non-financial entities utilizing crypto-assets for transactions or operational purposes should prepare, as MiCA’s reach may extend to businesses accepting crypto payments or leveraging blockchain for supply chain tracking. As a result, the onboarding process for users of crypto exchanges might lengthen, ensuring that clients are well-informed and suitable for specific products.

How to Prepare for MiCA and Adhere to Upcoming Regulation

As MiCA gears up for full implementation in 2024, crypto businesses should focus on these four actionable steps to ensure readiness and compliance:

1. Review and Classify Your Assets

Clearly identify whether your crypto-assets fall under asset-referenced tokens, e-money tokens, or other categories as defined by MiCA. Understanding these classifications is critical for adhering to the specific regulatory requirements set for each type.

2. Initiate the Licensing Process Early

Begin the process of applying for the necessary licenses well ahead of MiCA’s full effect to avoid potential backlogs as the December 2024 deadline approaches. For assistance in maneuvering the licensing process, Shift Markets offers support and expertise in MiCA compliance.

3. Adopt Transparency and Compliance Measures

Update your operational procedures to enhance transparency, particularly in areas such as trade transparency, record-keeping, and the disclosure of inside information. Implementing these measures in advance will facilitate a smoother transition to full MiCA compliance.

4. Engage with Regulatory Developments

Actively follow and participate in the MiCA consultation process, including providing feedback on consultation packages. Staying engaged with regulatory developments will not only keep you informed but also allow you to adjust your compliance strategies in real-time.

Conclusion and Next Steps

As the MiCA regulation approaches full implementation, the landscape of the cryptocurrency market within the European Union is poised for significant change. Businesses that proactively prepare for MiCA, taking the necessary steps to classify their assets, initiate the licensing process early, adopt compliance measures, and engage with ongoing regulatory developments, will position themselves advantageously.

Partner with Shift Markets for MiCA Success

For those looking to secure licensing before and during MiCA’s implementation, and seeking regulatory support for their crypto business endeavors, Shift Markets emerges as a pivotal enterprise solution. With a rich history of bridging traditional finance with the frontier of cryptocurrency and blockchain innovation, Shift Markets offers unparalleled expertise and support.

As MiCA ushers in a new era of regulation, partnering with Shift Markets provides businesses with the strategic guidance and technical solutions needed to navigate the complexities of compliance. Whether it’s through facilitating the licensing process, providing regulatory consultation, or integrating MiCA-compliant operations, Shift Markets is dedicated to ensuring your venture not only meets the required standards but excels in the burgeoning EU crypto market.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!