Share this article:

Hybrid crypto exchanges combine the liquidity and speed of centralized platforms with the security and autonomy of decentralized systems, offering users a balanced trading experience. They offer cross-chain trading, non-custodial management, and broader asset access for enhanced privacy and efficiency.

What is a Hybrid Crypto Exchange

Exchanges are essential for facilitating transactions. Centralized exchanges (CEX) offer high liquidity, fast transactions, and user-friendly platforms, but they require users to give up control over their assets. In contrast, decentralized exchanges (DEX) allow users to maintain control and privacy but often struggle with liquidity and slower transaction speeds.

A hybrid crypto exchange combines the strengths of both models. It offers the liquidity and speed of CEXs while providing the security and autonomy of DEXs, giving users a balanced option that appeals to both privacy-focused traders and those seeking efficient, high-volume transactions. In this article, we will break down the key differences between CEXs, DEXs, and explore the unique features of hybrid crypto exchanges.

What is a Centralized Exchange

Centralized exchanges (CEXs) are the most popular solutions where the platform acts as an intermediary, managing trades, user funds, and ensuring liquidity. They offer robust control, security, and compliance measures, making them a trusted choice for businesses looking for fast, secure transactions.

Advantages of Centralized Exchanges

Centralized exchanges provide high liquidity, ensuring smooth transactions and better price stability for traders. With control over the order book and infrastructure, they also deliver faster transaction speeds, offering an efficient trading experience. Additionally, their user-friendly interfaces prioritize ease of use, making them accessible to beginner traders with intuitive designs and straightforward navigation.

Disadvantages of Centralized Exchanges

Despite their advantages, centralized exchanges come with notable drawbacks. They are frequent targets for cyberattacks, given the large amounts of user funds and data they hold, making them vulnerable to security breaches. Users also relinquish control of their private keys and funds, placing their trust in the exchange to safeguard their assets. Additionally, centralized platforms must comply with regulations, which may limit user privacy and restrict participation in certain markets based on local laws.

What is a Decentralized Exchange

Decentralized exchanges (DEXs) facilitate peer-to-peer trading without the need for a central authority. Users retain control of their assets throughout the trading process, enhancing autonomy. DEXs rely on smart contracts for trade execution, but they often have lower liquidity compared to CEXs. Below are the benefits and drawbacks of using decentralized exchanges:

Advantages of Decentralized Exchanges

Decentralized exchanges give users full control over their private keys and assets, boosting personal security and autonomy. They also offer greater privacy, as they don’t require extensive KYC procedures or personal information. Additionally, without a central authority, decentralized exchanges provide access to global markets without the risk of government intervention.

Disadvantages of Decentralized Exchanges

However, decentralized exchanges often face lower liquidity, leading to less efficient trades and higher slippage. Transaction speeds can also be slower due to blockchain network congestion. Lastly, the complex user interface can create a challenging user experience for users unfamiliar with blockchain technology.

How Hybrid Exchanges Combine the Benefits of Centralized And Decentralized

Hybrid exchanges aim to find a middle ground between the models, combining the strengths from both centralized and decentralized platforms. They offer the fast, low-latency trading of centralized exchanges while incorporating decentralized privacy features through blockchain technology. This approach allows businesses to choose the right mix of features for their platform. Hybrid exchanges combine centralized security and speed with decentralized privacy and autonomy, offering traders a balanced solution.

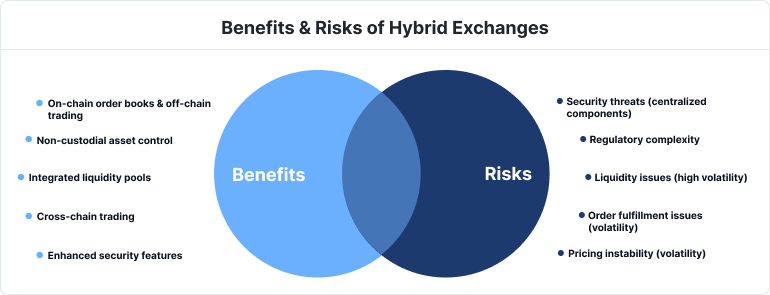

Hybrid crypto exchanges offer benefits like non-custodial control and cross-chain trading but face risks like security threats and liquidity issues.

Specific Features Hybrid Exchanges Offer

Hybrid exchanges provide unique features that blend elements of both centralized and decentralized platforms. With access to trading pairs from both CEX and DEX models, users benefit from a wider range of assets and markets. Below are some key features hybrid exchanges offer:

On-Chain Order Books

By using on-chain order books, where trade data is recorded directly on the blockchain, hybrid exchanges enable transparency. This allows trades to be auditable and publicly visible, ensuring user trust and accountability.

Off-Chain Trading

One of the most significant benefits of hybrid exchanges is that they utilize off-chain trading. By moving trades off the blockchain, hybrid exchanges can avoid network congestion, providing quicker trade execution and minimizing fees.

Non-Custodial Asset Management

Hybrid exchanges give users full control over their assets through non-custodial asset management, allowing users to retain access to their private keys at all times. This ensures that their funds are secure, even in the event of an exchange compromise.

Integrated Liquidity Pools

By combining liquidity from decentralized and centralized sources, hybrid exchanges offer improved liquidity, better pricing, and smoother trades.

Cross-Chain Trading

Through cross-chain trading, hybrid exchanges allow users to trade assets across multiple blockchains without intermediaries, expanding access to digital assets.

Enhanced Security Features

By combining decentralized storage with centralized oversight, hybrid exchanges can provide additional layers of security, protecting user assets while ensuring fast and efficient trading services.

Risks of Using a Hybrid Exchange

While hybrid exchanges combine the best of both CEX and DEX, they also come with risks. Hybrid models might still be vulnerable to security threats, as the centralized components can be targeted by hackers. Regulatory compliance may also be complex, as hybrid platforms must adhere to laws governing both centralized and decentralized transactions. Finally, there can be liquidity issues, particularly during high market volatility, which might affect order fulfillment and pricing stability.

User Autonomy in Hybrid Exchange Model

Hybrid exchanges offer users greater autonomy than traditional CEXs. Traders can control their private keys and have more flexibility in how they manage their digital assets. This combination of control and security allows users to participate in transactions with the assurance of decentralized systems, while still benefiting from the high liquidity and speed associated with centralized exchanges. Additionally, the ability to engage with both CEX and DEX features gives users more freedom in choosing how and where they want to trade.

Final Thoughts

Launching and maintaining a hybrid crypto exchange in 2025 requires a thoughtful blend of centralized efficiency and decentralized autonomy. With proper planning, compliance with regulatory standards, and an ability to adapt to evolving market trends, hybrid exchanges can attract a diverse user base and offer a unique trading experience. Success lies in the balance between liquidity, security, and user control, enabling your platform to thrive in a highly competitive space.

At Shift Markets, we offer a turnkey white label crypto exchange solution that enables custom user interfaces for high visual impact and unparalleled trading experience for users. Our solutions are designed to help you seamlessly integrate centralized and decentralized features, ensuring fast transaction speeds, high liquidity, and enhanced user autonomy. Request a free demo today to see how our platform can support your hybrid exchange’s growth and profitability.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!