Share this article:

Synthetic trading pairs are artificial currency or asset pairs created by combining two separate trades, often using a major currency or asset like the U.S. dollar as an intermediary. This approach allows traders to access less liquid or unavailable trading pairs by effectively creating them through indirect positions. In both forex and crypto markets, synthetic pairs offer a flexible way to engage with a broader range of assets.

What Are Synthetic Trading Pairs? A Quick Overview

The concept of creating a tradable instrument that mimics another asset has long been a cornerstone of financial markets. Synthetic trading pairs are a perfect example of this, allowing traders to construct artificial currency or asset pairs by trading two separate instruments. This strategy is used when direct trading pairs are not available or lack liquidity. What becomes possible through synthetic asset creation? Traders gain access to previously unavailable markets, diversify their portfolios, and implement higher-level trading strategies with greater flexibility.

How Synthetic Trading Pairs Operate: A Closer Look

Synthetic assets work by combining two or more instruments to replicate the value or behavior of another asset. In both traditional forex and crypto markets, traders use intermediary assets—often a highly liquid one like the U.S. dollar—to create synthetic pairs. For instance, instead of directly trading a pair that lacks liquidity, a trader can simultaneously trade two more accessible pairs, such as buying one pair and selling another. This effectively replicates the movement of a third pair, giving the trader exposure to an otherwise unavailable market.

For a real-world example, imagine a trader who wants to trade the Australian dollar (AUD) against the Canadian dollar (CAD), but their broker doesn’t offer this pair directly. To achieve this, the trader can create a synthetic AUD/CAD pair using the U.S. dollar (USD) as an intermediary. First, they buy AUD/USD, meaning they are buying Australian dollars and selling U.S. dollars. Then, they sell USD/CAD, meaning they are selling U.S. dollars and buying Canadian dollars. These two trades effectively cancel out the U.S. dollar, allowing the trader to replicate the movement of AUD against CAD. Alternatively, some brokers or exchanges configure synthetic pairs as their own trading instruments, packaging the two trades into one, so traders can access the AUD/CAD pair directly without managing separate positions.

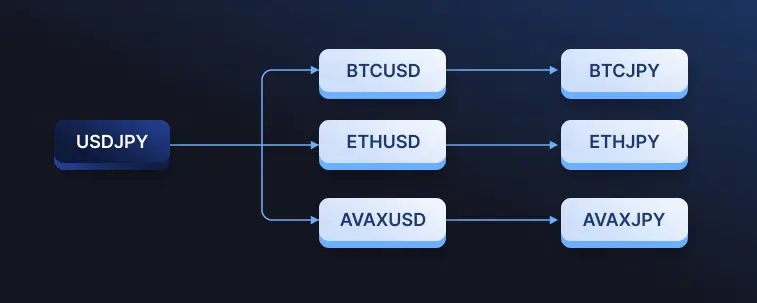

This diagram illustrates how synthetic currency pairs can be constructed by using intermediary trades. In this case, the base pair is USD/JPY (U.S. Dollar to Japanese Yen), and it is used as an intermediary currency for creating synthetic trading pairs with cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Avalanche (AVAX).

Advantages of Trading Synthetic Currency Pairs

Trading synthetic currency pairs offers several distinct advantages, especially for traders looking to access less liquid or unavailable markets. One key benefit is the flexibility to create trading pairs that aren’t directly quoted by brokers or exchanges, allowing for a broader range of trading options. Synthetic pairs also enable traders to reduce spread costs in some cases, particularly when combining trades with high-liquidity currencies like the U.S. dollar.

Traders can also trade synthetic pairs through derivatives contracts, enabling them to overcome liquidity difficulties by mimicking price movements of currencies that may not be readily accessible. This allows traders to speculate on markets with limited liquidity or hedge their exposure without needing to hold the actual currencies. Additionally, synthetic pairs can present cleaner trends and opportunities, giving traders more control over their strategies in volatile markets.

Different Variations of Synthetic Assets

Synthetic assets come in various forms, each designed to mimic real-world assets or financial instruments in different ways. These assets can be built using derivatives and smart contracts, offering diverse trading opportunities across markets. Below are the main types of synthetic assets commonly used in both traditional and crypto markets.

Synthetic Currency Pairs

Synthetic currency pairs are created by combining two or more trades to simulate a currency pair that isn’t directly available. They are commonly used in forex markets to access less liquid or non-quoted currency pairs, with the U.S. dollar often acting as an intermediary.

Synthetic Commodities

These assets mirror the value of physical commodities like gold, oil, or silver without needing to hold the underlying assets. They allow traders to speculate on commodity prices using blockchain-based tokens, offering flexibility in markets that may otherwise be inaccessible.

Synthetic Stocks

Synthetic stocks replicate the price movements of real-world company shares, such as Apple or Tesla. These are popular in decentralized finance platforms, providing investors with exposure to equity markets without owning the actual shares.

Synthetic Cryptocurrencies

Synthetic cryptocurrencies are tokens designed to track the price of other digital currencies like Bitcoin or Ethereum. These are most commonly used to create liquidity and provide exposure to multiple cryptocurrencies in DeFi platforms, enabling a broader range of trading strategies.

Benefits and Drawbacks of Synthetic Currency Pairs

While synthetic currency pairs offer unique advantages, they also come with potential challenges. Traders should weigh the benefits and drawbacks before incorporating them into their strategies.

Benefits

Synthetic currency pairs provide access to a wider range of markets, especially those with lower liquidity or unavailable direct trading pairs. They allow for more flexibility in creating tailored trading strategies, offering opportunities for hedging and speculation across different assets. Also, synthetic pairs can reduce spread costs when using high-liquidity currencies as intermediaries. This flexibility can lead to more strategic opportunities in otherwise limited trading environments.

Drawbacks

The primary drawback of synthetic pairs is the increased complexity and risk associated with managing two separate trades to create one position. This approach can lead to higher margin requirements, larger spreads, and increased transaction costs. It should also be mentioned that synthetic pairs expose traders to interest rate differentials between the currencies involved, which could impact profitability. For less experienced traders, the complexity and costs may outweigh the potential benefits, making synthetic pairs better suited for more advanced market participants.

Conclusion

Synthetic trading pairs open up opportunities for traders to access markets that are typically harder to reach. By using synthetic assets, traders can overcome liquidity challenges and employ more maneuverable trading strategies. While these advantages are appealing, they come with the need for careful management due to the complexity and risks involved. For those well-versed in market dynamics, synthetic trading pairs can offer valuable tools for expanding trading possibilities.

For individuals looking for advanced synthetic pair functionality and market-making software, Shift Markets offers a solution designed to meet your trading needs. Our platform provides the tools to support your strategies and gain access to global markets. Contact us today to learn more about how we can support your trading goals.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!