Summarize with AI:

The Shift Platform Back Office is a centralized control system that gives exchange operators full oversight of their platform. It allows for the management of user accounts, liquidity, and trading configurations, while providing real-time data and analytics to optimize performance. Operators can tailor fee structures, manage market-making settings, and maintain a smooth exchange environment through this powerful tool.

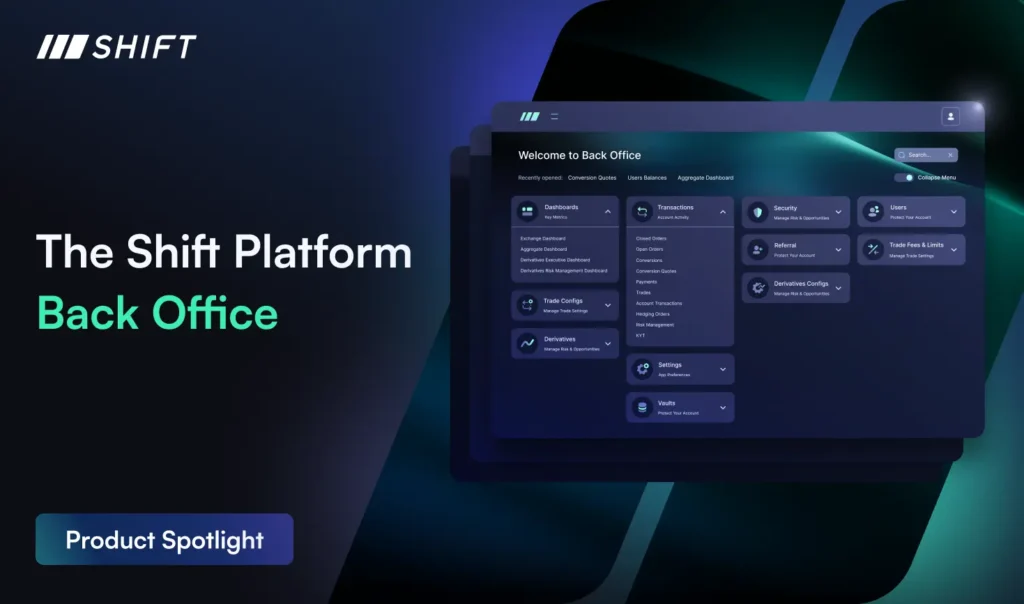

Product Spotlight: The Shift Platform Back Office

Imagine a highly advanced crypto exchange platform equipped with all the trading tools and financial features operators could ever need—but with one glaring problem: there’s no way for the operator to control anything. User activity unfolds without oversight, liquidity moves without tracking, and compliance becomes an afterthought. In this scenario, even the most sophisticated exchange would quickly descend into chaos, lacking the oversight required to keep things running smoothly.

What if there was a way to have complete oversight and control over an exchange environment? The Shift Platform Back Office offers exactly that, providing a centralized, intuitive interface that empowers operators to manage every aspect of their exchange platform. The Back Office allows for precise management of user accounts, customizable fee structures, liquidity flows, and compliance settings—all from one control center. It integrates real-time performance monitoring, enabling operators to make informed decisions quickly. With advanced tools for security, derivatives management, and treasury control, the Back Office transforms complex exchange operations into a fully manageable and streamlined system.

Bridging User Experience and Operational Control

The Shift Platform white label exchange is divided into two essential components: the user-facing front end, where traders engage with the platform, and the operator-facing Back Office, which powers the exchange’s operations. While users interact with features like trading, wallet balances, and payments on the front end, the Back Office gives operators full control over everything happening behind the scenes. Operators have the ability to manage user settings, monitor trading activity, control liquidity, and set fee structures. This connection ensures that every aspect of the user experience is aligned with the operator’s goals, providing seamless operational oversight.

The Back Office provides granular functionality that allows operators to fine-tune the exchange. Operators can customize user permissions, create and assign fee groups, manage KYC compliance, and monitor treasury activity with precision. This level of control extends to setting trading conditions and monitoring transactions, ensuring the platform operates according to their exact specifications. These features work together to give operators real-time visibility, which we’ll explore further through the platform’s powerful dashboard system in the next section.

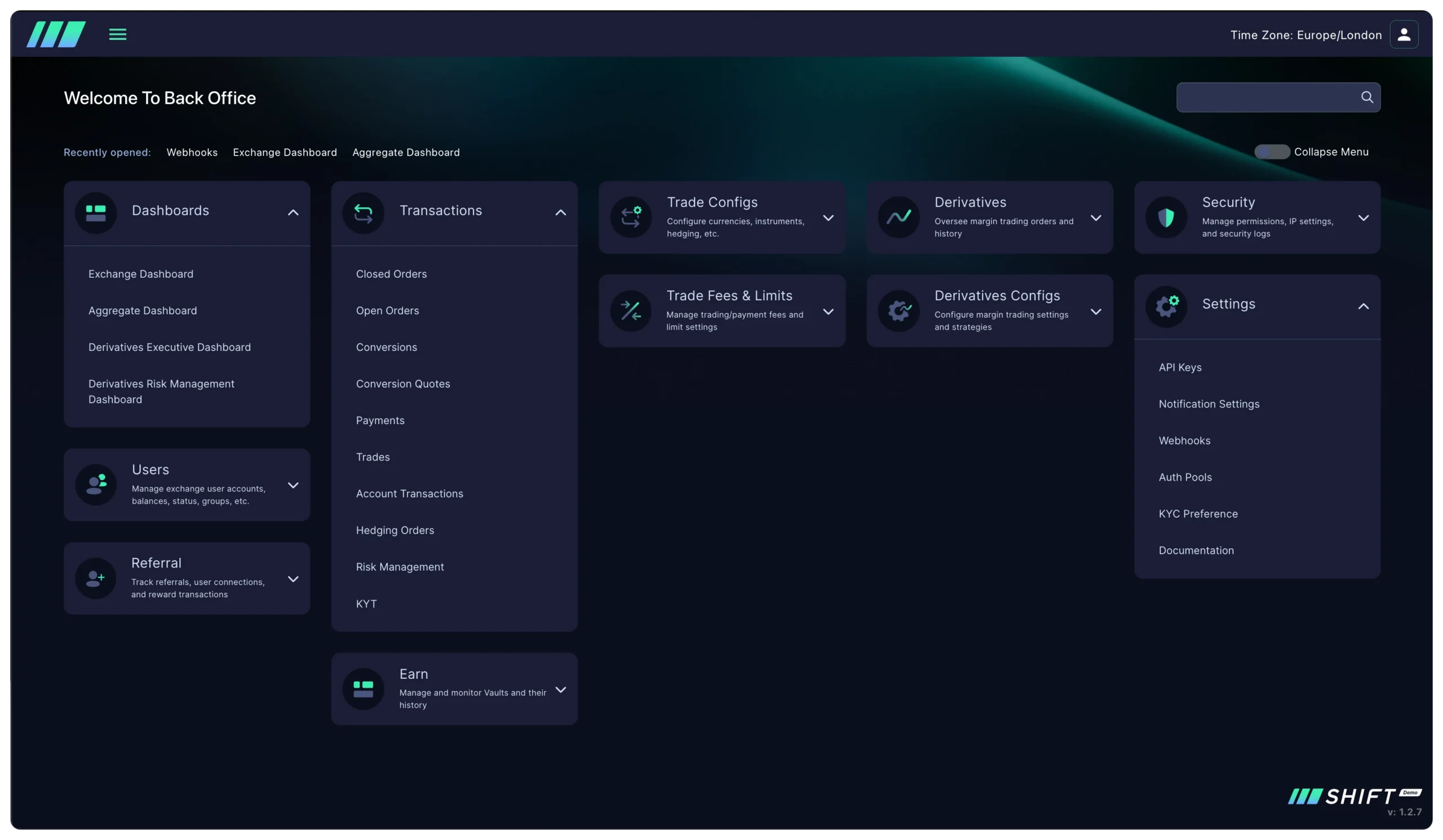

This is the main navigation view of the Shift Markets Back Office, offering operators quick access to key sections such as dashboards, user management, transactions, and trade settings. From here, operators can efficiently manage various aspects of exchange operations, including security, derivatives, and API configurations.

Real-Time Exchange Oversight Through Dashboards

The Back Office offers a suite of dashboards that provide exchange operators with a complete view of the platform’s performance. The Exchange Dashboard offers detailed insights into broker balances, custodian funds, hedging activity, and more, allowing operators to monitor liquidity and financial flows. Meanwhile, the Aggregate Dashboard gives a broader, high-level overview of the exchange’s operations, including total trading volume, deposits, withdrawals, and profits. This vantage point even includes a geo-map of user activity, offering operators visibility into global engagement.

Each dashboard is designed to provide targeted insights into specific aspects of the exchange, such as derivatives trading or risk management. For instance, the Derivatives Executive Dashboard gives an overview of all derivatives activity, while the Risk Management Dashboard allows operators to track exposure across the exchange and liquidity providers, ensuring control over complex trading environments. These dashboards enable operators to make data-driven decisions, monitor trends in real time, and adjust key settings to optimize exchange performance.

This is the Aggregate Exchange Dashboard view, providing a comprehensive overview of exchange health. It displays key metrics such as trading volume, collective deposits, withdrawals, and profits, along with a global map of user activity.

This is the Aggregate Exchange Dashboard view, providing a comprehensive overview of exchange health. It displays key metrics such as trading volume, collective deposits, withdrawals, and profits, along with a global map of user activity.

Immutable Transaction Ledger

The Transaction Record (otherwise known as the Digital Asset Ledger) section of the Back Office acts as an immutable ledger, logging every open and closed order, conversion, payment, and trade on the exchange. This provides operators with the capability to monitor individual user balances and manage transactions with precision, seamlessly extending the functionality of their existing custody solutions. Operators can maintain accurate and up-to-date account records while ensuring transaction integrity. Additionally, enhanced compliance and audit tools, paired with real-time record keeping, ensure transparent and secure operations across the platform.

Order Book and Market Control

The Trade Configuration and Trade Fees & Limits section of the Back Office gives operators full control over their market-making parameters and order book structures. Operators can choose which currencies and instruments to offer, aligning with the goals of their exchange. They can also craft custom order books through synthetic pair functionality and order book aggregation across multiple liquidity providers, ensuring a consistent and liquid trading environment. This allows operators to configure payment routes, connecting fiat or crypto transactions with providers like Fireblocks, making it easier to manage how payments are processed and displayed on the platform.

The flexibility ensures transactions are handled smoothly according to the exchange’s needs.

Operators can set up specific fee structures for each trading pair, whether through flat fees or progressive percentage-based fees based on trade volume. They can assign fee groups to different user segments, such as KYC-verified users, new traders, or high-volume users, allowing for personalized fee strategies. This level of control over fees, market-making parameters, and the ability to set specific markups to the bid or ask side of the order book helps optimize liquidity and trading environments, providing a balanced and adaptable experience for all user groups.

Centralized User Management

The User Management section of the Back Office equips operators with immediate access to critical user data, including balances, trading activity, KYC levels, and associated crypto wallets. Having all this information at their fingertips allows operators to swiftly assess and respond to user needs, monitor compliance, and track every detail of user behavior across the platform. This consolidated view simplifies the management of user accounts and ensures operators can efficiently oversee security, trading permissions, and overall platform health with confidence and precision.

This view offers a detailed view into individual exchange users, displaying their account details, KYC status, and fee group assignments. Operators can review and upload important user documentation, including identification and registration forms, while also accessing personal information, address details, and more.

Derivatives Trading Oversight

The Derivatives section of the Back Office gives operators comprehensive control and oversight of all derivatives trading activities. With consolidated views of user trading behavior, including leverage, profit and loss (P&L) history, and instruments traded, operators can closely monitor and manage performance. Operators also have the ability to set unique fee groups specifically for derivatives, configure Markup ASK/BID settings, and manage hedging strategies. Considering the importance of derivatives in attracting users, these features enable operators to fine-tune the trading environment and optimize platform performance through real-time data and detailed control.

Security and Exchange Control Settings

The Security section of the Back Office offers complete control over the platform’s safety protocols. Operators can manage IP whitelisting, blacklisting, and geo-blocking to control user access securely. Admin approval requests and audit logs ensure every action is tracked and authorized, maintaining a transparent environment. Operators also have the ability to configure API access for third-party integrations and manage active webhooks, providing secure connectivity across the platform.

In the Exchange Settings section, operators can manage exchange-wide user permissions, such as restricting margin trading to specific groups, using a structured approval request menu. This section also allows operators to oversee KYC history and documentation for users, ensuring compliance with regulatory standards. By controlling API keys, notification settings, and webhooks, operators can keep their exchange environment secure while managing user activity and third-party connections from a consolidated and intuitive view.

Closing Thoughts

It’s difficult to fully encapsulate all the capabilities of the Shift Platform Back Office in a concise article, as its features extend far beyond what we’ve covered here. From managing liquidity and trading configurations to overseeing derivatives and user activity, this tool offers comprehensive control for exchange operators. These core functionalities are just a glimpse of what makes the Back Office an essential asset for ensuring efficient, secure, and high-performing crypto exchanges. For operators looking to optimize their platforms, the Back Office is an indispensable tool offered by Shift Markets.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!