Summarize with AI:

Crypto Market Makers vs Brokers: Understanding the Key Differences

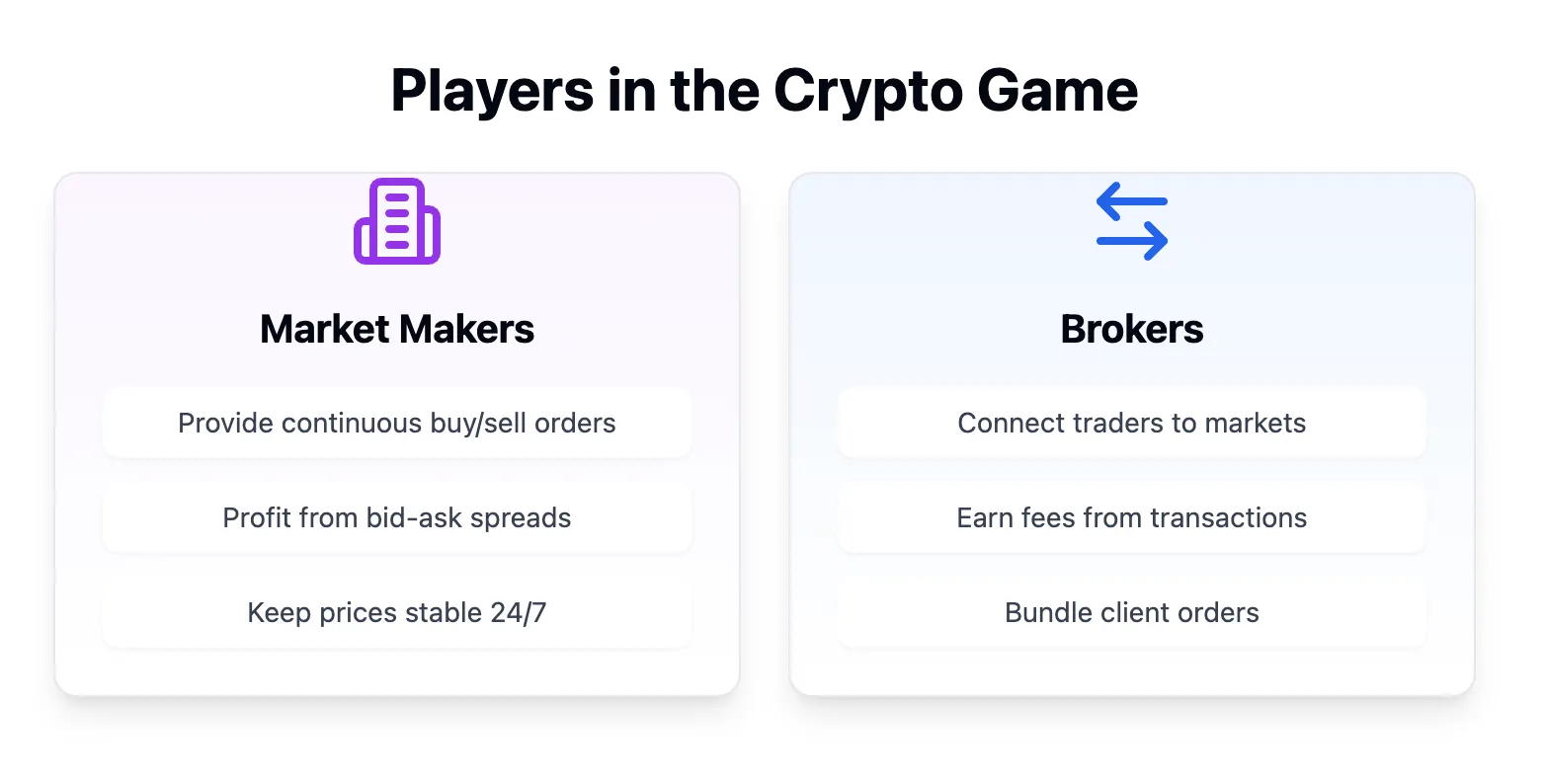

There’s a fine line between market makers and brokers in the crypto trading ecosystem, yet their roles directly impact how centralized exchanges and brokerages operate. In tbe crypto ecosphere, market makers provide liquidity, balancing market activity and enabling trades, while brokers facilitate transactions by connecting clients to these markets. Both play distinct roles in supporting trading activity. This article breaks down how these roles influence the structure and performance of centralized exchanges and brokerages, with real-world examples to illustrate their impact.

Market makers and brokers serve distinct roles in crypto trading, with market makers providing liquidity through active buy and sell orders and brokers connecting traders to markets by facilitating transactions. Market makers profit from bid-ask spreads, stabilizing prices and enabling smooth trade execution, while brokers earn through commissions or fees, offering clients access to exchanges and trading tools. Together, they create a functional ecosystem, balancing liquidity and accessibility for traders and centralized exchanges.

Who Are Market Makers?

Market makers are financial institutions, brokerages, or specialized trading firms that play a significant role in crypto markets by providing liquidity. They continuously place buy and sell orders, ensuring that traders can execute trades without delays or extreme price fluctuations. Their presence helps centralized exchanges maintain active markets, especially for less popular or newly listed tokens.

For instance, when Coinbase launched support for Polygon’s MATIC token, market makers were engaged to ensure liquidity in the early days of trading. Without their involvement, traders might have faced wide bid-ask spreads or insufficient trade volumes, making it difficult to buy or sell the token. By consistently quoting buy and sell orders, market makers helped the exchange offer a reliable market, attracting participants and establishing MATIC as a tradable asset on the platform.

What Are Brokers?

Brokers are intermediaries that connect traders to markets, facilitating the buying and selling of cryptocurrencies on behalf of their clients. They typically serve retail investors, institutions, and businesses seeking access to centralized exchanges without directly managing complex trading systems. In the context of liquidity, brokers aggregate orders from their clients and route them to exchanges, contributing to trading volume and liquidity on those platforms.

For instance, a crypto broker servicing institutional clients might consolidate buy and sell orders from multiple firms and execute them on an exchange like Binance. By pooling these orders, the broker helps create larger, more consistent trade flows, indirectly sourcing liquidity in the market. This enables clients to trade larger volumes without significant price impact, while also ensuring they meet compliance requirements and benefit from additional services such as market analysis and trade execution strategies.

Market Makers vs. Brokers: Differences and Similarities

While both market makers and brokers play key roles in centralized crypto markets, their functions and approaches differ significantly. Market makers focus on providing liquidity by actively placing buy and sell orders, ensuring the market remains active and prices remain stable. In contrast, brokers act as intermediaries, facilitating trades on behalf of their clients by connecting them to exchanges and executing orders.

A key difference lies in their motivations: market makers trade for their own accounts, profiting from the spread between bid and ask prices. Brokers, on the other hand, earn revenue through commissions or fees for services they provide to their clients. Additionally, market makers are essential to the mechanics of the market itself, while brokers primarily serve as a conduit for clients to access those markets.

Despite these differences, both contribute to market liquidity in distinct ways. Market makers directly inject liquidity by maintaining active order books, while brokers aggregate client trades, increasing overall trading volume. Together, they create a functional trading ecosystem where market participants can execute trades efficiently, whether they are retail traders, institutions, or businesses.

How Market Makers and Brokers Generate Revenue

Market makers and brokers generate revenue in distinct ways, and these strategies directly influence the trading experience for individuals.

Market Makers: Earning Through Spreads

Market makers profit from the bid-ask spread—the difference between the price they buy and sell an asset. For instance, a market maker might buy Bitcoin at $36,500 and sell it at $36,505, earning $5 per Bitcoin traded. These spreads, while small, accumulate significantly across high trading volumes. For traders, this means slightly higher costs when buying and lower returns when selling. It should be noted, the liquidity provided by market makers ensures faster order execution and more stable pricing, even during periods of high market volatility.

Brokers: Profiting From Fees

Brokers earn revenue through commissions, transaction fees, or markups on trades. For example, a broker might charge a 0.5% fee on a $10,000 trade, earning $50. Brokers’ revenue models can influence the overall cost of trading for individuals, especially for frequent traders or those executing large orders. Traders indirectly contribute to broker profits by driving trading activity, but in return, they gain access to exchanges and often benefit from user-friendly tools and services brokers provide.

The revenue strategies of market makers and brokers ultimately shape the trading environment. Market makers’ spreads impact trade profitability but support liquidity, while brokers’ fees can increase trading costs while simplifying market access. Traders should remain aware of these dynamics to better understand how their activities contribute to the broader trading ecosystem.

Final Thoughts

Market makers and brokers are indispensable components of the crypto trading ecosystem, each playing a unique role in shaping how centralized exchanges operate. While market makers focus on liquidity and pricing stability, brokers simplify market access and connect traders to these exchanges. Their revenue models—spreads for market makers and fees for brokers—directly influence trading costs and the overall experience for market participants.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!