Share this article:

How Stablecoins are Transforming Cross-Border Finance

In the ever-evolving landscape of cross-border finance, one bold assertion resounds with undeniable significance: stablecoins are not just a fleeting trend but a transformative powerhouse reshaping global transactions. The surge in stablecoin adoption underscores their unique advantages — stability, convenience, and trust.

As we delve into the unmatched convenience of direct peer-to-peer transactions and the transparency afforded by blockchain technology, the stage is set for a groundbreaking examination of stablecoins in cross-border finance.

Amid promises of efficiency and innovation, regulatory challenges loom large. Join us on this journey as we dissect stablecoins, draw distinctions from digital fiat, scrutinize global oversight, and explore innovative applications shaping the future of cross-border finance.

Key Takeaways:

-

The surge in global stablecoin adoption highlights their triumphant trio of benefits: Unwavering stability, unmatched convenience in peer-to-peer transactions, and a foundation of trust through transparent blockchain operations.

-

There is a critical need for a unified international regulatory framework surrounding stablecoin use. The absence of such coordination poses substantial risks, emphasizing the urgency for a cohesive effort to ensure stability and safeguard users.

-

Despite regulatory ambiguity, stablecoins are being creatively utilized in a plethora of new ways, exemplified by Visa’s integration with Solana and Shift’s collaborative on-chain FX rail, showcasing their transformative potential in the cross-border finance landscape.

Stablecoins: Stability, Convenience, and Trust

The rapid adoption of stablecoins stands as a testament to their unique advantages. Stability, a fundamental characteristic, ensures that the value of stablecoins remains pegged to a fiat currency, providing users with a reliable store of value.

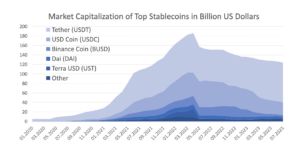

Source: Christophbertsch.com

Stablecoins introduce unparalleled convenience to cross-border transactions by eliminating the need for intermediary banks and complex routing, allowing for direct and instant transfers between parties. This direct peer-to-peer capability streamlines the process, reducing dependency on traditional banking networks and ushering in a new era of decentralized, efficient financial transactions.

Stablecoins also foster trust through their transparent and decentralized nature, providing users with visibility into the coin’s underlying reserves and ensuring a clear peg to fiat currency. The blockchain technology supporting stablecoins enables real-time tracking of transactions, offering a tamper-resistant and auditable record.

This transparency, coupled with the stability in value, enhances user confidence and contributes to the establishment of trust in the broader financial network. For an in-depth understanding of how to create your own stablecoin, read our detailed guide, “How to Create a Stablecoin: A Guide by Shift Markets.”

Comparing Digital Fiat to Stablecoins: The Evolution of Digital Currencies

While stablecoins fall under the broader umbrella of digital currencies, it’s essential to distinguish them from the concept of digital fiat (or eMoney). Traditionally used as the default form of currency for cross-border transfers, digital fiat refers to currency stored in banking computer systems and supported by fiat currency.

Unlike stablecoins, digital fiat encompasses a broader range of digital currencies that may not necessarily be pegged to traditional fiat currencies. The key differentiator lies in the stability factor – while stablecoins maintain a steady value, digital fiat may experience fluctuations based on foreign exchange rates.

This begs the question – Are stablecoins or digital fiat better or worse for cross-border transactions? The incorporation of smart contract functionality sets stablecoins apart by introducing programmability to their transactions. Smart contracts are self-executing agreements with predefined rules, enabling automated and complex financial operations on the blockchain. This inherent capability empowers stablecoins with greater efficiency, allowing for automated interest payments, decentralized lending, and intricate financial instruments.

The programmability of smart contracts not only enhances the speed and cost-effectiveness of transactions but also fosters an ecosystem of decentralized applications, marking stablecoins as a cross-border payment solution with vast potential for innovation in the digital financial landscape.

International Oversight and Regulatory Imperatives for Stablecoins

The Current Landscape of Stablecoin Regulation

The regulation of stablecoins on an international scale is currently grappling with challenges stemming from a lack of clear and unified standards. As stablecoins continue to bridge the gap between traditional finance and the crypto realm, the absence of a well-defined regulatory framework raises concerns.

Presently, stablecoins, particularly those tied to the US dollar and backed by high-quality bonds, are witnessing significant growth. However, the regulatory oversight remains fragmented, with non-bank entities issuing stablecoins operating in a lightly regulated or unregulated environment. The absence of comprehensive, consistent, and globally coordinated standards poses a risk, especially given the rapid growth and increased integration of stablecoins into the broader financial ecosystem.

Assessing the Regulatory Response to Stablecoins

The current regulatory response to stablecoins needs a closer look, especially in the context of their growing influence and cross-border nature. While there’s recognition of the need for a nuanced, risk-based approach, the reality is a varied landscape of regulatory practices globally. Concerns around the potential risks of dollarization or cryptoization, particularly in emerging markets, highlight the urgency for effective international coordination.

The lack of a standardized approach to disclosure from stablecoin issuers and intermediaries further complicates matters. To enhance stability and protect users, a more cohesive and globally synchronized effort is required in regulatory responses. The evolving nature of stablecoins and their impact on financial systems necessitates a proactive and collaborative stance from regulators worldwide.

CPMI’s Evaluation of Stablecoin Transactions

The Committee on Payments and Market Infrastructures (CPMI) acts as an international standard-setting body, endorsing, overseeing, and providing recommendations for the safety and efficiency of payment, clearing, settlement, and associated systems to bolster financial stability and the broader economy. Recent scrutiny by the CPMI has brought forth concerns regarding stablecoin transactions.

The report brings attention to the promising yet intricate landscape of using stablecoins in cross-border payments. While acknowledging the potential benefits such as increased speed and reduced costs, it underscores the pressing need for international collaboration to establish consistent regulations and address potential risks. The CPMI wisely calls for further exploration and research to better understand the implications of stablecoins on both domestic and cross-border payment systems, emphasizing the importance of staying ahead of the curve in the evolving global financial landscape.

Innovations, Applications, and Future Trajectories

Practical Applications in Action: Visa

Interoperability proves to be a key challenge in the stablecoin space, necessitating seamless communication and transferability across networks, given the diverse development of stablecoins on different blockchain platforms. These challenges, stemming from variations in protocols, consensus mechanisms, and smart contract languages, have prompted developers to explore innovative solutions.

Notably, Visa is intensifying its involvement in the stablecoin realm, aiming to enhance the speed of cross-border payment transactions. The company has extended its stablecoin settlement capabilities, integrating Circle’s USDC stablecoin with the Solana (SOL) blockchain, known for its high transaction speeds without sacrificing decentralization. When consumers use Visa cards for purchases at millions of worldwide merchant locations, they enjoy the convenience of nearly instant payment authorizations. Behind the scenes, the funds utilized in their purchase must traverse between their bank (the issuer) and the merchant’s bank (the acquirer). Visa’s treasury and settlement systems play a crucial role in facilitating the clearing, settlement, and movement of billions in daily transactions, ensuring the accurate transfer of the preferred currency from the issuer to the acquirer.

This process unfolds across almost 15,000 financial institutions and spans over 25 currencies globally. Visa’s integration of Circle’s USDC stablecoin with the Solana blockchain signifies a pioneering move among major financial institutions, showcasing a transformative shift towards the efficiency of stablecoins in global payments and highlighting the company’s dedication to enhancing cross-border payment speed.

The Impact of Stablecorp, Circle, and Shift Markets’ Collaboration

Stablecorp, Circle, and Shift Markets joined forces to revolutionize cross-border finance with a transformative on-chain foreign exchange (FX) rail connecting Canada and the United States. Spearheaded by Shift Markets, this collaborative initiative facilitated the seamless transfer of assets entirely on-chain. The practical application of this approach notably benefited the Canada SailGP Team, enabling them to efficiently disburse payments to athletes and suppliers on a global scale.

Traditional money wiring is burdened by several drawbacks that the on-chain FX rail seeks to overcome. Firstly, the conventional process is notorious for its time-consuming nature, involving multiple intermediaries and a series of manual verification steps. This can result in significant delays in the completion of transactions, impacting the timeliness of payments for athletes and suppliers. Additionally, traditional international money transfers are associated with higher fees, as financial institutions typically charge various fees for currency conversion, wire transfers, and intermediary services, leading to increased overall transaction costs. The inefficiencies in the traditional wiring system, characterized by its complexity, delays, and elevated costs, underscore the need for more streamlined and technologically advanced solutions like the on-chain FX rail.

The establishment of an on-chain FX rail connecting Canada and the United States signifies a major leap forward in the evolution of digital payment – This major collaboration enabled assets to flow entirely on-chain, presenting a tangible advancement in the landscape of cross-border finance.

Future Perspectives

In wrapping up our exploration of stablecoins in the cross-border finance arena, it’s evident that these digital currencies are reshaping global transactions with undeniable potential. While stability, convenience, and trust make stablecoins a game-changer, the lack of regulatory clarity poses a significant hurdle. Real-world applications like Visa’s strategic moves and collaborative initiatives by industry leaders underscore the transformative power of stablecoins. As we traverse this evolving landscape, a proactive and globally synchronized regulatory approach is crucial to harness the full benefits of stablecoins, ensuring a secure and improved future for cross-border finance.

For enterprises seeking reliable partners in stablecoin issuance and asset tokenization, Shift Markets emerges as a leading force. With a proven track record in facilitating transformative on-chain FX solutions, Shift Markets paves the way for powerful cross-border transactions, making us an ideal collaborator in navigating the dynamic landscape of digital finance. Dive into the future of digital finance with us—contact us today to learn how Shift Markets can elevate your financial strategies here.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!