Share this article:

Updated November 4, 2024

Crypto market making is the process where individuals or firms place buy and sell orders for digital assets to provide liquidity on exchanges, helping to stablilize prices, reduce volatility, and improve market efficiency. Market makers profit from the bid-ask spread while playing a primary role in supporting active and liquid cryptocurrency markets, benefiting both retail and institutional traders. This guide covers the fundamentals of crypto market making, strategies for profitability, and the benefits and challenges involved.

Crypto Market Making Guide: Mastering the Fundamentals

We understand that market making can be a complex and often misunderstood topic that plays an fundamental role in cryptocurrency ecosystems. At its core, crypto market making is the practice of placing both buy and sell orders on an exchange to provide liquidity for a digital asset. This means that market makers are always ready to buy or sell, which keeps the market active and allows trades to happen quickly and at consistent prices. Without market makers, it would be harder to buy or sell cryptocurrencies, leading to larger price swings and a less stable market overall.

This article will help you understand the basics of crypto market making, the strategies involved, and why market makers are so important in keeping digital asset markets liquid and efficient. Written for both experienced trader or those just getting started in the crypto world, this guide will give you a clear understanding of how market making works and why it matters.

Role of a Crypto Market Maker

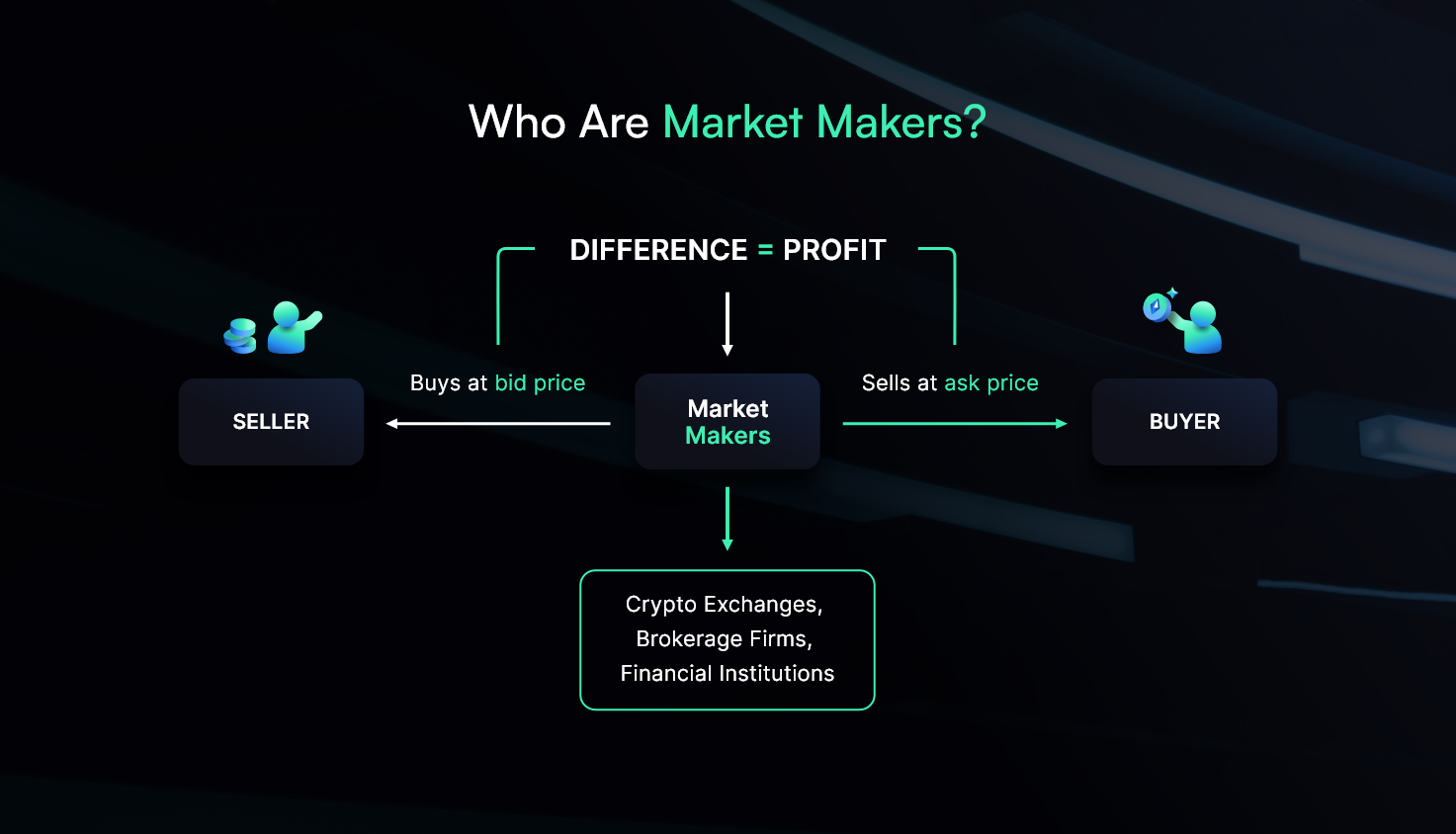

A crypto market maker plays a vital role in the cryptocurrency markets by constantly placing buy and sell orders for digital assets. This continuous activity ensures there is always someone available to trade with, which helps maintain liquidity—meaning traders can execute transactions without significant delays or price fluctuations. Market makers profit from the difference between the buy and sell prices, known as the spread, while also stabilizing the market by narrowing this spread.

The presence of market makers reduces the chances of large price swings by absorbing sudden shifts in supply and demand. This stability attracts more participants, including institutional investors, and supports a smoother trading environment. In essence, market makers are the backbone of any active crypto exchange, fostering a reliable and consistent market for all traders.

Requirements for Becoming a Market Maker

Becoming a crypto market maker requires a significant commitment of capital, as market makers need to maintain enough funds to place large buy and sell orders. Exchanges often set minimum capital thresholds, sometimes reaching hundreds of thousands of dollars, to guarantee that market makers can consistently provide liquidity. Alongside capital, utilizing advanced technology is key. Many market makers depend on high-level trading algorithms and automated software to handle high-frequency trades and respond to market changes quickly.

A reliable technical infrastructure is necessary, including fast connections to multiple exchanges, secure data storage, and strong risk management systems. Building partnerships with exchanges is equally important, as these relationships can offer access to market-making programs, lower trading fees, and other incentives that help improve profitability. Through meeting these requirements, a market maker can successfully contribute to the liquidity and stability of cryptocurrency exchange, platforms, and overall markets.

Real Strategies for Crypto Market Making

In order to become a successful crypto market maker, you need practical strategies that help manage risk, maintain liquidity, and maximize profits. Below are three key strategies, with actionable examples, that can set you up for success in cryptocurrency market making.

1. Managing Bid-Ask Spreads

Managing the bid-ask spread is one of the most fundamental strategies in market making. The spread is where market makers earn their profits, but striking the right balance is key. For example, imagine you’re making a market for a cryptocurrency with a current price of $1000. You could set your buy (bid) price at $999.6 and your sell (ask) price at $1000.4. This $0.8 spread is your profit per trade.

As a market maker, you can adjust your spreads based on market conditions. In highly volatile markets, you might widen the spread to cover potential risks. On the other hand, during periods of high liquidity and competition, narrowing the spread (e.g., $999.8 to $1000.2) can attract more trades, increasing volume and compensating for a smaller spread.

2. Controlling Inventory Risk

Inventory risk management is about making sure you don’t hold too much of any one asset, which could expose you to price fluctuations. For instance, if you are providing liquidity for a token like BTC and the market drops suddenly, holding large amounts of BTC could lead to losses. To avoid this, market makers monitor their inventory levels and rebalance their positions frequently.

Set an upper and lower limit for how much of each asset you’re willing to hold. For example, if you’re market making on a platform with ETH and your goal is to hold no more than 100 ETH, you could automatically adjust your bids to sell excess ETH when your inventory exceeds this threshold. Conversely, if your inventory dips below 50 ETH, adjust your bids to buy more until you’re back within your target range.

3. Utilizing Automated Trading Algorithms

Automation plays a huge role in modern market making. By using automated trading software, market makers can place thousands of trades across multiple exchanges in a fraction of the time it would take manually. For instance, an algorithm can automatically adjust bid-ask spreads based on current market conditions or execute arbitrage strategies between exchanges to capitalize on price differences.

Start by using market-making software that integrates with multiple crypto exchanges via APIs. For example, configure your algorithm to monitor prices on platforms like Binance and Coinbase. If it notices a 1% price difference for the same asset, it can buy low on one exchange and sell high on another, locking in small profits with minimal manual effort.

These examples show how you can apply specific strategies to succeed as a market maker. With a combination of spread management, inventory control, and automation, you can build a profitable and sustainable market-making business in the crypto space.

Financial Rewards and Market Impact of Market Making

Market making offers several (exceptionally lucrative) financial benefits, primarily through earning profits from the spread between buy and sell prices. By consistently placing buy and sell orders, market makers capture small but frequent gains, which can accumulate into significant profits over time. In addition to spreads, many crypto exchanges offer rebates or reduced trading fees to incentivize market makers, further boosting their earnings.

Beyond direct financial rewards, market makers play a primary role in increasing liquidity across crypto exchanges. This added liquidity creates more trading opportunities for other participants, helping to stabilize prices and encourage larger trading volumes. By maintaining a steady flow of transactions, market makers make crypto markets more accessible and efficient for all traders.

Challenges and Risks in Market Making

Crypto market making, while profitable, comes with its share of challenges. Market volatility is a major risk, as sudden price swings can lead to losses if market makers hold too much of an asset during a downturn. Managing this inventory risk, while still providing liquidity, requires careful (and constant) attention. Another challenge is staying competitive, as market makers must maintain tight bid-ask spreads to attract traders, all while other market makers are competing for the same trades.

To address these challenges, automated trading algorithms can be used to adjust bid-ask spreads based on real-time market conditions, reducing the impact of sudden price fluctuations. Risk can also be managed by hedging positions across various exchanges or assets, reducing exposure to any single market shift. By employing these strategies, market makers can balance risk and reward, maintaining profitability in volatile and competitive markets.

Final Thoughts

Becoming a successful crypto market maker requires a combination of strategy, technology, and careful risk management. By mastering techniques like managing bid-ask spreads, controlling inventory, and leveraging automation, market makers can overcome the challenges presented by cryptocurrency markets. In addition to the financial benefits, market makers play an important role in maintaining liquidity and stability in the digital asset spectrum. With the right tools and approach, market making offers a rewarding and lucrative path in the world of higher level crypto trading.

Shift Markets stands as the industry leader in crypto market making software and technology, offering advanced tools like synthetic pair functionality and access to abundant liquidity. With Shift’s platform, market makers can refine their strategies and manage risk with greater precision. Partner with Shift Markets to strengthen your presence in the digital asset market.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!