Share this article:

Crypto Exchange Order Types: Which Ones Should You Offer?

Selecting the right order types for your crypto exchange is essential to attracting traders, optimizing liquidity, and scaling trading volumes. While basic spot trading order types are sufficient for smaller exchanges with lower trading activity, high-volume exchanges and derivatives platforms require advanced order execution tools to meet the demands of institutional and professional traders.

In this article by Shift Markets, we explore the most essential order types for both spot and derivatives trading, their benefits, and why exchanges should implement advanced order execution tools as they scale.

Key Takeaways:

-

Basic order types like market, limit, and stop orders are essential for spot trading, ensuring fundamental trade execution and liquidity management.

-

Advanced order types such as OCO, TWAP, and iceberg orders improve execution efficiency, reduce slippage, and attract institutional and high-volume traders.

-

Integrating derivatives trading with advanced order execution unlocks new revenue streams, enhances risk management, and increases exchange competitiveness

Essential Order Types for Spot Trading

For new or lower-volume exchanges, a focus on basic order types is essential to ensure smooth market operations.

Market Orders

Market orders execute immediately at the best available price, ensuring fast trade execution. They are ideal for traders who prioritize speed over price control, particularly in highly liquid markets where slippage is minimal. Since market orders are filled instantly, they are commonly used when entering or exiting a position quickly is more important than achieving a specific price. However, in volatile or low-liquidity markets, they can lead to unfavorable execution prices due to slippage. Exchanges benefit from market orders by facilitating liquidity flow, ensuring transactions occur even in fast-moving market conditions.

Limit Orders

Limit orders allow traders to set a predefined price for buying or selling an asset. A buy limit order executes only at the set price or lower, while a sell limit order executes only at the set price or higher. This provides traders with greater control over execution and protects them from price fluctuations. One of the main advantages of limit orders is precision—they prevent traders from executing trades at undesirable prices. However, there is no guarantee of execution, as the market must reach the specified price for the order to be filled. Exchanges that offer limit orders provide traders with a tool to optimize their entry and exit points while maintaining more stable order books.

Stop Orders (Stop-Loss & Stop-Limit)

Stop orders help traders automate risk management by triggering a market or limit order once an asset reaches a predefined price. A stop-loss order converts into a market order upon reaching the stop price, ensuring execution but at an uncertain price. A stop-limit order, on the other hand, converts into a limit order, ensuring price control but with the risk of non-execution. These orders are particularly useful for protecting profits or limiting losses in volatile markets. Traders use stop orders to automate their exit strategy, reducing the need for constant market monitoring. For exchanges, offering stop orders enhances the trading experience by providing users with tools to manage downside risk effectively.

For exchanges catering to retail traders or those with moderate trading volumes, offering these basic order types ensures accessibility and usability.

Advanced Order Types for High-Volume Exchanges

While spot trading attracts new traders, high-volume exchanges rely on derivatives trading to drive institutional participation and increase revenue. Offering advanced order types alongside futures and perpetual swaps enhances execution efficiency, reduces slippage, and strengthens risk management.

One-Cancels-the-Other (OCO) Orders

OCO orders combine two conditional orders—typically a limit order and a stop order—where the execution of one automatically cancels the other. This allows traders to define both their profit-taking and stop-loss levels within a single setup, making it useful for traders managing multiple positions or those who want to automate their trading strategy without manually adjusting their orders. Exchanges that support OCO orders attract more advanced traders who require flexible and automated risk management tools.

Trailing Stop Orders

Trailing stop orders are dynamic stop orders that automatically adjust based on market movement. Instead of setting a fixed stop price, the stop price moves up or down by a fixed percentage or dollar amount as the asset price changes. This allows traders to lock in gains while letting profitable trades continue running. If the price moves favorably, the stop level moves with it, but if the market reverses, the stop triggers a sell or buy order. Trailing stops are particularly beneficial in trending markets where traders want to capture upside potential while protecting against downturns.

Iceberg Orders

Iceberg orders allow traders to execute large transactions without revealing the full order size to the market. Instead, the order is split into smaller portions, with each portion becoming visible in the order book only after the previous one is filled. This order type is commonly used by institutional traders and high-net-worth individuals who want to minimize market impact and prevent other traders from reacting to large orders. Exchanges benefit from iceberg orders by catering to institutional liquidity providers, improving market stability, and reducing volatility from large transactions.

Time-Weighted Average Price (TWAP) Orders

TWAP orders execute trades in smaller increments over a set period, ensuring a balanced average price across multiple transactions. This prevents large orders from significantly affecting the market price and helps traders reduce slippage. This strategy is favored by institutional traders and algorithmic trading firms that execute large volumes while maintaining execution efficiency. Exchanges offering TWAP orders support advanced execution strategies, making them attractive to professional traders and liquidity providers.

Bracket Orders

Bracket orders are a risk management tool that combines three orders in one—a primary order, a take-profit order, and a stop-loss order. When the primary order executes, the other two orders become active. If the take-profit order is hit, the stop-loss order cancels, and vice versa. This type of order is ideal for traders looking to manage both risk and profit-taking in a single step, reducing manual trade adjustments. Exchanges that offer bracket orders provide an efficient way for traders to automate entry and exit strategies.

By integrating these advanced order types, exchanges can cater to professional traders and institutions, boosting liquidity and trading volume.

Choosing the Right Order Types for Your Exchange

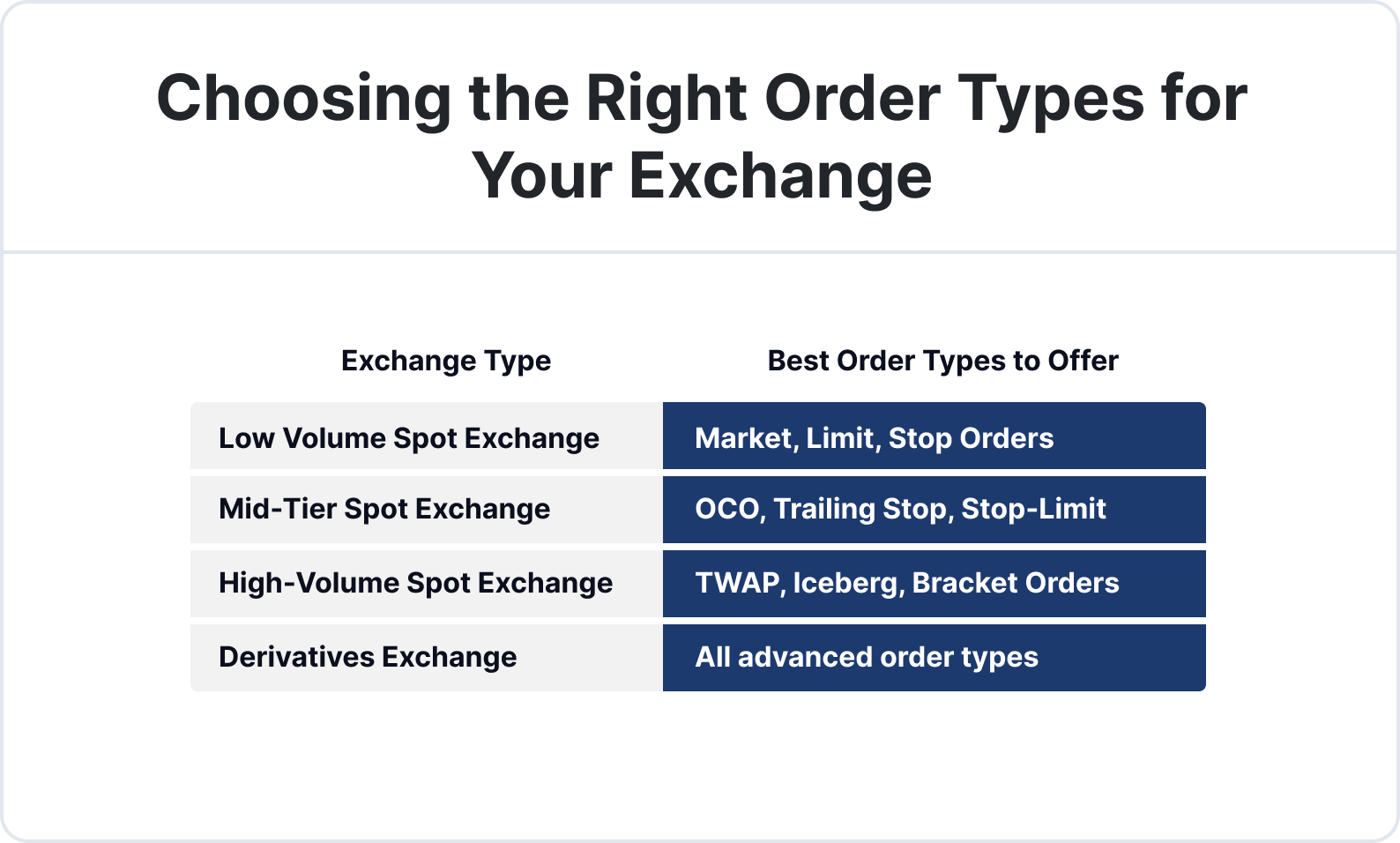

When deciding which order types to offer, consider your exchange’s user base:

As crypto derivatives trading continues to grow, exchanges that provide comprehensive order execution tools will have a competitive edge.

Conclusion

Offering the right set of order types can significantly impact an exchange’s liquidity, user experience, and trading volume. While market and limit orders are essential for all platforms, advanced order execution tools such as TWAP, iceberg, and bracket orders are crucial for high-frequency and derivatives trading.

Exchanges that embrace derivatives trading and advanced execution strategies will attract a broader range of traders, including institutional investors and hedge funds, ensuring sustained growth and profitability

.

For exchanges looking to integrate advanced trading tools, derivatives markets, and institutional-grade execution, Shift Markets provides a complete trading infrastructure solution. Contact us to learn more about how we can help you scale your exchange.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!